of section 16, see Codification note set out under section 411 of this title. For classification to this title of other pars. Collateral shall not be required for Federal Reserve notes which are held in the vaults of, or are otherwise held by or on behalf of, Federal Reserve banks. The said Board of Governors of the Federal Reserve System may at any time call upon a Federal Reserve bank for additional security to protect the Federal Reserve notes issued to it. The Federal Reserve agent shall each day notify the Board of Governors of the Federal Reserve System of all issues and withdrawals of Federal Reserve notes to and by the Federal Reserve bank to which he is accredited. In no event shall such collateral security be less than the amount of Federal Reserve notes applied for. The collateral security thus offered shall be notes, drafts, bills of exchange, or acceptances acquired under section 92, 342 to 348, 349 to 352, 361, 372, or 373 of this title, or bills of exchange endorsed by a member bank of any Federal Reserve district and purchased under the provisions of sections 348a and 353 to 359 of this title, or bankers' acceptances purchased under the provisions of said sections 348a and 353 to 359 of this title, or gold certificates, or Special Drawing Right certificates, or any obligations which are direct obligations of, or are fully guaranteed as to principal and interest by, the United States or any agency thereof, or assets that Federal Reserve banks may purchase or hold under sections 348a and 353 to 359 of this title or any other asset of a Federal Reserve bank. Such application shall be accompanied with a tender to the local Federal Reserve agent of collateral in amount equal to the sum of the Federal Reserve notes thus applied for and issued pursuant to such application. Application for notes collateral requiredĪny Federal Reserve bank may make application to the local Federal Reserve agent for such amount of the Federal Reserve notes hereinbefore provided for as it may require.

23, 1935, changed name of Federal Reserve Board to Board of Governors of the Federal Reserve System. Statutory Notes and Related Subsidiaries Change of Name

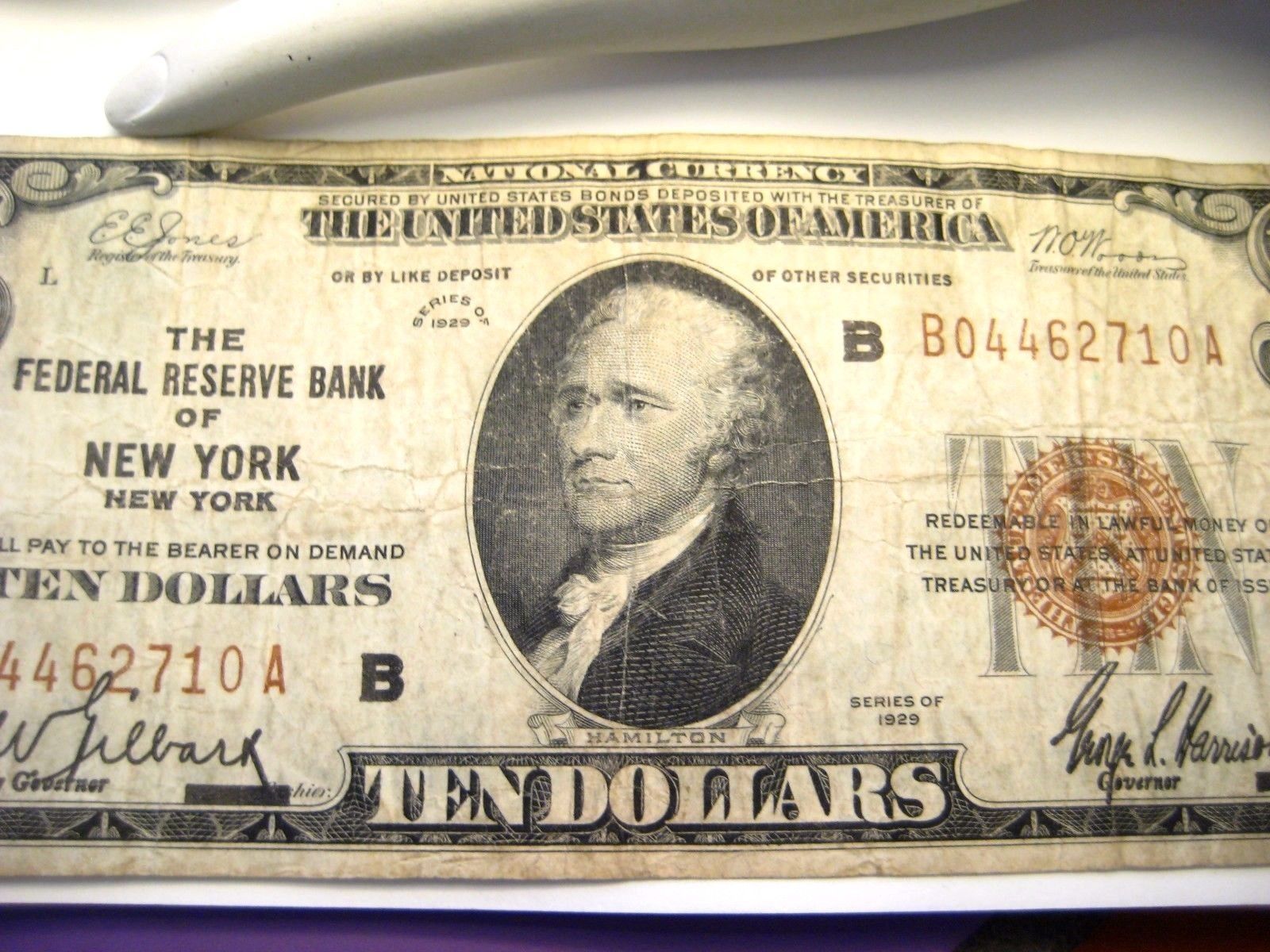

30, 1934, struck out from last sentence provision permitting redemption in gold. 23, 1913, formerly classified to section 422 of this title, was superseded by act June 26, 1934, ch. 11 (formerly 12) of section 16 of act Dec. 23, 1913, formerly classified to sections 415 and 467, respectively, of this title, were repealed by Pub. 2 to 5, 6 (formerly 7), 7 to 10 (formerly 8 to 11, respectively), 12 (formerly 13), 13 (formerly 14), and 14 to 16 (formerly 15, 16, and 18, respectively) of section 16 of act Dec. For classification of these sections to the Code, see Tables. Reference probably means as set forth in sections 17 et seq. Phrase "hereinafter set forth" is from section 16 of the Federal Reserve Act, act Dec. They shall be redeemed in lawful money on demand at the Treasury Department of the United States, in the city of Washington, District of Columbia, or at any Federal Reserve bank. The said notes shall be obligations of the United States and shall be receivable by all national and member banks and Federal reserve banks and for all taxes, customs, and other public dues. Issuance to reserve banks nature of obligation redemptionįederal reserve notes, to be issued at the discretion of the Board of Governors of the Federal Reserve System for the purpose of making advances to Federal reserve banks through the Federal reserve agents as hereinafter set forth and for no other purpose, are authorized. From Title 12-BANKS AND BANKING CHAPTER 3-FEDERAL RESERVE SYSTEM SUBCHAPTER XII-FEDERAL RESERVE NOTES §411.

0 kommentar(er)

0 kommentar(er)